Weaponized Dollar Will Explode in America's Face

By incentivizing foreign governments to seek currency alternatives, U.S.-led sanctions could end the dollar's global dominance and cause havoc at home

There’s much to despise about economic sanctions. Aside from the fundamental immorality of making innocent individuals suffer for the sins of governments, sanctions almost universally fail to achieve the goals of those who inflict them.

Nonetheless, sanctions have become the knee-jerk U.S. government response to any real or claimed foreign misdeed. According to the U.S. Treasury department, the number of U.S.-imposed sanctions soared 933% between 2000 and 2021.

Where today’s Ukraine invasion-prompted sanctions are concerned, civilians in Russia and all around the world are already feeling the effects, via increasingly expensive and scarce food, fuel and other goods.

In the end, however, the greatest damage may be inflicted on the United States government and its citizens: By incentivizing Russia and other countries to stop using U.S. dollars for trade, the sanctions regime threatens to topple the dollar from its position of global preeminence. That could spell disaster for the American economy and hasten the end of the U.S. empire.

Understanding U.S. Dollar Dominance

What makes the U.S. dollar valuable? Once, it was the fact that it was convertible to gold. Over time, however, that convertibility was sharply curtailed, and then Richard Nixon completely eliminated it in 1971.

Since then, the U.S. dollar has existed as a fiat currency, which is to say it isn’t backed by anything whatsoever. Fiat currencies are only valuable to the extent individuals, businesses and foreign governments consider them so.

Today, the dollar’s dominance rests on two key pillars:

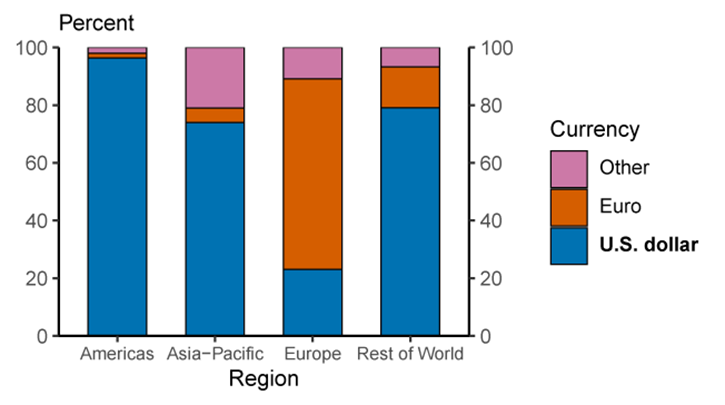

The dollar is the world’s primary reserve currency. Reserve currencies are held by countries’ central banks for purposes that include use in international transactions and the servicing of debts. In 2021, U.S. dollars represented 60% of foreign reserves. Most of those reserves are held in the form of U.S. Treasury debt.

Most international trade is conducted with dollars and, notably, the dollar is the principal currency used in energy trading around the world.

In addition, many countries, including Saudi Arabia, Qatar, the UAE and Panama, peg their currency to the dollar. Where many currencies were once backed by gold or another commodity, those countries allow their currencies to be exchanged for a fixed amount of dollars. That compels those countries to have dollars on hand to meet conversion requests.

Though economic sanctions have proven a generally futile means of achieving regime change or other foreign policy objectives, U.S.-led sanctions do have a severe economic impact.

That impact is greater because of the dollar’s domination of global finance—and since trade in dollars is handled by correspondent banks of the U.S. Federal Reserve who are bound to comply with sanctions, even commerce among other countries is subject to blockade by the American government.

Cracks Forming in the Dollar’s Global Foundation

Now, however, recent developments suggest the weaponization of the U.S. dollar could be backfiring, with profound, long-lasting consequences:

China, the world’s second-largest economy by GDP, started buying Russian oil and coal with Chinese yuan. As Bloomberg reported, “China has long bristled at the dollar’s dominance in global trade and the political leverage it gives the [United States]. Efforts to chip away at the status quo are now being accelerated by Western steps to punish Russia for its war of aggression.”

Russia briefly offered to buy gold from Russian banks at a rate of 5,000 rubles per gram, which had the effect of linking the ruble to the price of gold.

That could be the first move in a global shift away not only from the U.S. dollar, but away from fiat currencies in general—and back toward real, commodity-backed money.

Saudi Arabia—which has exclusively sold its oil and gas for dollars since 1974—has accelerated discussions with China about pricing some Saudi oil sales in yuan. It may prove to be mere scimitar-rattling by Saudi royals angry over the potential revival of the Iran nuclear deal, and disappointed the U.S. government hasn’t done more to aid the kingdom’s calamitous war in Yemen. Regardless, the mere entertaining of the idea shakes a key pillar of U.S. dollar dominance.

India—the world’s third-largest oil importer—is, according to Reuters, “exploring ways to set up a rupee payment mechanism for trade with Russia to soften the blow on New Delhi of Western sanctions imposed on Russia…Indian officials are concerned vital supplies of fertilizer from Russia could be disrupted as sanctions intensify, threatening India's vast farm sector.”

India’s contemplation of rupee transactions underscores the fact that one needn’t be a current target of U.S. sanctions to be harmed by them.

Meanwhile, in the face of the American empire’s relentless and compulsive use of sanctions to punish noncompliance with its edicts, any rational government would be wary of the possibility of being targeted over some future controversy with Washington.

“This may be the dollar’s last hurrah,” said Euro Pacific Capital CEO and financial commentator Peter Schiff on his podcast, “because what’s really going on right now, geopolitically, is we are reminding much of the world why it has to move off the dollar standard, especially some of these larger economies that are regarded as our enemies, like China, and some of China’s friends, like India, and now of course Russia.”

“And I think the Arab world is also taking a hard look at what’s going on right now and considering their tenuous relationship with the United States and how easy it would be for some future president to vilify Saudi Arabia or any of those countries for a host of political reasons, and I think a lot of people are waking up to the reality of the dangers that this dollar reserve system portends for the rest of the world.”

Consequences of a Dethroned Dollar

Whether it’s gradual or sudden, an international overthrow of the dollar as the preeminent reserve and international trade currency would unleash many harms on the United States, among them:

Costlier imports and rising prices. Lower demand for dollars decreases their value and buying power. (On the plus side, cheaper dollars make U.S. exports more affordable to foreign buyers.)

Higher government borrowing costs. Most foreign U.S. dollar holdings exist in the form of U.S. Treasury obligations, and 33% of all U.S. debt was held by foreign investors in 2021. Since bond yields are inversely related to bond prices, a global U.S. bond sell-off would raise Uncle Sam’s interest rate.

Higher rates on mortgages, credit cards and auto loans. Treasury debt serves as a benchmark for other forms of debt, so consumers would see their own borrowing costs rise too.

Rising deficits. Higher interest rates mean more money spent on interest payments to service the federal government’s colossal $30 trillion debt.

Pick your poison: Higher taxes, decreased spending and/or runaway inflation. Ballooning deficits would either necessitate far higher taxes, a sharp contraction of America’s welfare-warfare state, or a hyper-inflationary acceleration of the Federal Reserve’s practice of buying Treasury debt with money created out of thin air.

The end of prosperity created by the Fed’s printing press. The global demand for dollars fuels a dynamic in which the government can run enormous deficits and Americans are able to consume far more than they produce—essentially importing products and exporting fiat dollars and Treasury debt.

In short, the dethroning of the dollar would signal the end of what then-French finance minister Valéry Giscard d’Estaing called America’s “exorbitant privilege.”

Does This Cloud Have a Gold Lining?

By incentivizing a global detachment from the U.S. dollar, the foolhardy American government is poised to inflict far more damage on itself and its citizens than on Russia.

Though it would be a cathartic and painful transition for the United States, some lasting good could come from a dethroning of the dollar, particularly if it came in the form of a global return to commodity-backed currencies.

The dollar’s previous convertibility to gold didn’t just give it real value, it also acted as a restraint on the creation of new money—since the Federal Reserve had to ensure it could meet conversion requests. That restraint helps fend off price inflation, and serves as a check on U.S. government spending.

To the extent U.S. sanctions become less impactful on innocents abroad, and spending restraint curtails the U.S. government’s rampant military interventionism, that’s a silver lining for people beyond our shores too.

great analysis

whether the dollars decline is slow or sudden it’s still a few years away.

but it will be disastrous to kick this can down the road yet again. america needs to make some inroads into that $30 trillion in debt and raise interest rates to lower inflation and ensure our debt is still attractive. would also be a great idea to buy more gold to underpin the $. handouts are always nice—& do buy votes. but if the $ issue is ignored there will be no more handouts forever

Very very written…and very scary….